Affidavite For Expenses refers to a sworn statement used to verify specific business expenditures when standard receipts fall short or when a higher level of verification is required. In this article, we explore how to avoid common pitfalls, ensuring your Affidavite For Expenses is accurate, compliant, and ready for review.

We’ll cover practical steps to document, verify, and audit expenses with confidence, and we’ll highlight common mistakes to avoid so your accounting records stay clean and auditable.

Key Points

- Ensure the Affidavite For Expenses aligns with jurisdictional rules and your company policy.

- Attach all supporting receipts, invoices, and correspondence referenced in the affidavit.

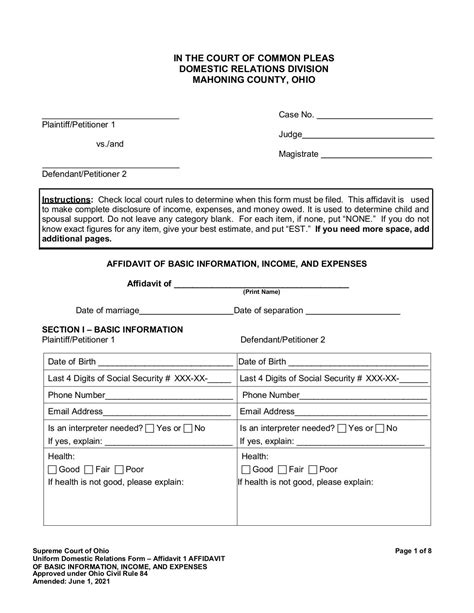

- Specify the exact amount, date, and purpose to prevent ambiguity.

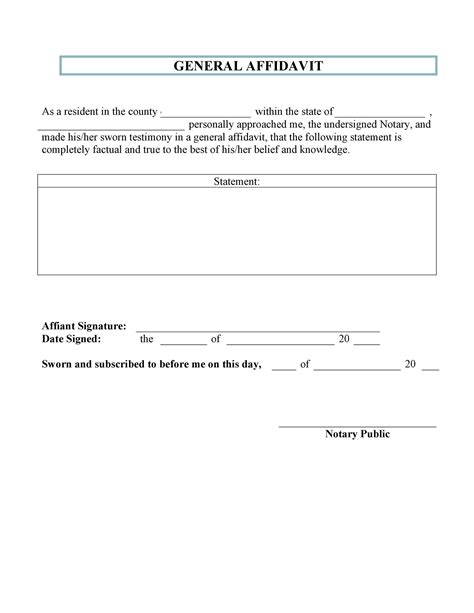

- Use proper authentication, including notary or authorized signatories when required.

- Maintain an organized audit trail with digital copies and version control.

Understanding When to Use Affidavite For Expenses

An affidavit for expenses is typically employed in scenarios where standard documentation is incomplete, disputed, or when a higher level of attestation is necessary for internal controls, tax purposes, or regulatory reviews. The affidavit provides a concise, sworn summary that ties the expense to a specific business activity, helping to confirm legitimacy while preserving an auditable trail. Accuracy and documentation quality are the cornerstones here, ensuring that the affidavit complements, rather than replaces, primary receipts and approvals.

When preparing an Affidavite For Expenses, think in terms of context, sourcing, and validation. The narrative should clearly connect the expense to a concrete business outcome, the amount to a verifiable bill, and the date to a real transaction. This approach reduces back-and-forth with auditors and minimizes the chance of disputes later on.

Common Pitfalls to Avoid With Affidavite For Expenses

1. Vague or Inaccurate Amounts

Double-check the claimed figure, including taxes, gratuities, reimbursements, and currency conversions if applicable. Ambiguity around the total amount invites questions and undermines confidence in the affidavit.

2. Missing or Inconsistent Supporting Documents

Reference every attachment in the affidavit and ensure identifiers (invoice numbers, purchase orders, or vendor codes) match. Missing receipts or mismatched references are a frequent source of delays during audits.

3. Ambiguous Purpose or Business Justification

State the business reason clearly and tie it to a project, client engagement, or operational activity. Vague language can obscure the link between the expense and value to the company.

4. Incorrect Jurisdiction, Notary, or Signatory Details

Confirm who can sign, whether a notary is required, and how the affidavit should be executed within your jurisdiction and governance framework. Incorrect signatories undermine enforceability and credibility.

5. Poor Record-Keeping and Version Control

Maintain a consistent naming convention, timestamps, and secure storage for affidavits and attachments. A tangled archive increases risk during financial reviews and audits.

Best Practices for Effective Affidavite For Expenses Management

Develop a standard workflow that includes a templated affidavit, a fixed set of required attachments, and a clearly defined approval chain. Use a checklist to validate each element before submission. Automation can help enforce field completeness and reduce human error, while regular training keeps teams aligned on policy expectations.

Adopt a formal retention policy for affidavits and their supporting documents, and consider digital signatures where legally permissible. A well-documented process enhances transparency and supports smoother audits.

What is the purpose of an Affidavite For Expenses?

+An Affidavite For Expenses provides sworn attestation that a specific expense is legitimate and accurately documented. It usually includes details like the amount, date, purpose, and references to supporting documents, and it is used in cases where ordinary receipts are insufficient or when additional validation is required for audits or regulatory review.

Do all expenses require an affidavit?

+No. An affidavit is typically reserved for situations where documentation is incomplete, disputed, or when a higher level of verification is needed. Routine expenses with complete receipts may not require an affidavit, but organizations may still use affidavits for high-value items or compliance reasons.

How should I format an Affidavite For Expenses to ensure clarity?

+Use a standard template that includes the claimant’s information, date, amount, business purpose, and references to attachments. Include a clear statement of verification, any notary or signatory details if required, and a link or reference to all supporting documents. Keep language precise and free of ambiguity.

What steps should I take if a supporting document is missing?

+Document the absence in the affidavit, note the reason, and attempt to obtain a replacement or ancillary confirmation from the vendor. If replacements aren’t possible, describe the risk and impact, and consider alternatives such as a sworn declaration from the responsible party or management approval to proceed with documented attribution.